About Moneyport PSS (MPSS)

MONEYPORT

What MPSS is

Moneyport Payment Settlement System (MPSS) is an institutional-grade settlement orchestration platform for the UK–GCC corridor. It enables regulated banks, payment institutions, and licensed financial firms to execute cross-border FX settlement with atomic Payment-versus-Payment (PvP) logic — meaning both legs settle together, or not at all.

MPSS is engineered as non-custodial infrastructure: Moneyport does not hold client funds on its balance sheet, does not provide retail accounts or wallets, and does not engage in deposit-taking or lending. Settlement is executed either via existing domestic payment rails (Scenario 1) or within a closed-loop institutional tokenised settlement environment (Scenario 2), with a cryptographic audit trail anchored for non-repudiation.

- + Institutional-only participation (regulated entities only)

- + Atomic PvP execution to eliminate principal / settlement risk

- + ISO 20022 + API connectivity for straight-through integration

- + Real-time observability, reconciliation, and compliance reporting

Why it matters for the UK–GCC corridor

Traditional correspondent settlement introduces cut-off constraints, delayed finality, complex reconciliation, and bilateral principal risk. MPSS provides a modern, bank-aligned pathway to:

- + Reduce settlement delays and operational overheads

- + Improve liquidity efficiency (less reliance on prefunding structures)

- + Strengthen auditability and compliance transparency across jurisdictions

- + Support corridor expansion beyond BHD/GBP into additional GCC pairs post-licensing

How MPSS works

MPSS supports two interoperable operating models designed for phased deployment and regulatory alignment:

In Scenario 1, MPSS synchronises both currency legs using a smart orchestration layer and executes settlement directly on domestic payment rails. No digital asset is issued. Both counterparties pre-authorise irrevocable domestic instructions; MPSS releases both legs only on an atomic match.

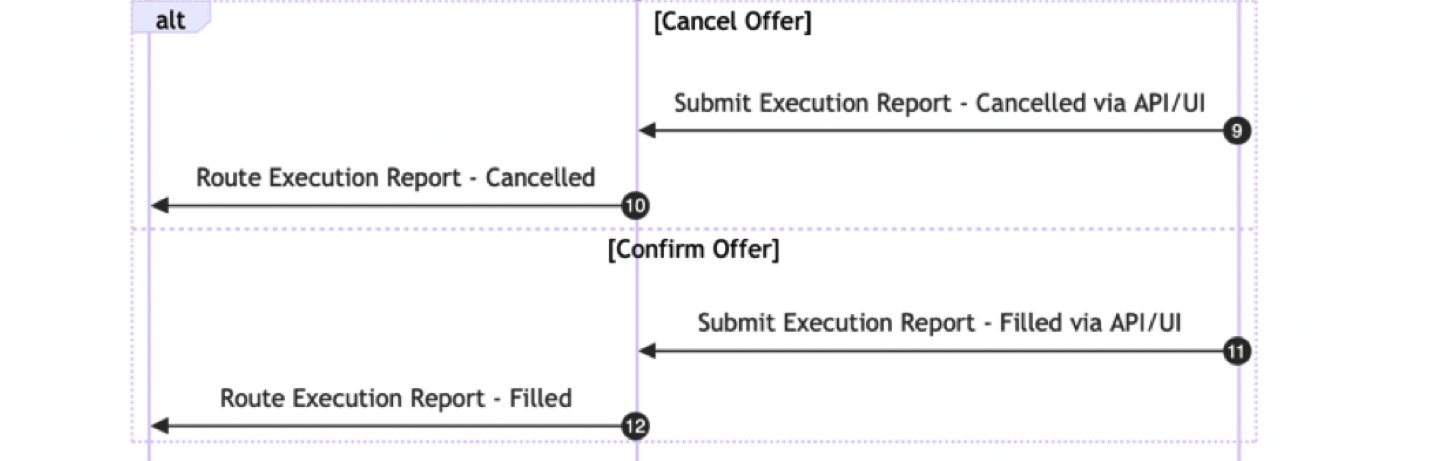

Typical transaction lifecycle

- + Counterparties submit signed FX terms (rate, notional, time window) via API

- + Orchestration layer validates parameters and locks a synchronisation state

- + Each side pre-authorises domestic transfer instructions with its bank

- + On atomic match, MPSS triggers ISO 20022 messages to both rails

- + Both legs execute; confirmations return via webhook and MI exports

- + Transaction metadata is hash-anchored for auditability (no custody / no value transfer on-chain)

Key characteristics

- + Non-custodial orchestration (Moneyport does not hold client funds)

- + Conservative, interoperable model (works alongside existing banking infrastructure)

- + Atomic execution reduces principal risk and reconciliation burden

- + ISO 20022 + REST APIs for integration

- + Real-time compliance checks and status visibility

Performance targets

API registration is designed for sub-second handling, with settlement execution typically completed within domestic rail timeframes and immediate finality reporting through platform confirmations and audit anchors.

Scenario 2 introduces closed-loop tokenised fiat settlement instruments used strictly within a whitelisted institutional network. Tokens represent safeguarded fiat held 1:1 in segregated accounts at licensed banks and are minted/burned only after bank confirmation. There is no retail access, no open-market distribution, and no balance-sheet float.

Token lifecycle (high-level)

- + Mint: client deposits fiat to safeguarding account → bank confirms → token minted to whitelisted wallet

- + Lock: tokens are locked for an agreed PvP transaction window

- + Atomic PvP: both legs swap simultaneously under MPSS orchestration

- + Burn/Redemption: tokens returned → burned → fiat released from safeguarding account

Controls & perimeter

- + Whitelist-only participation (regulated institutions, approved wallets)

- + 1:1 safeguarding parity with daily reconciliation

- + No interest, rehypothecation, or maturity transformation

- + Regulator-facing observability and reporting exports

- + Designed for future interoperability (including CBDC-ready architectural principles)

Important clarification

This model is purpose-built for institutional settlement workflows. The instruments are not designed as retail products, and participation is restricted to licensed institutions with approved onboarding, compliance, and technical controls.

MPSS service modules

MPSS is delivered as a modular B2B SaaS/PaaS platform for regulated institutions, built around eight interconnected service modules:

PvP FX Settlement Services

Atomic coordination of both legs of FX settlement across the corridor.

Fiat Tokenisation Infrastructure

Closed-loop issuance/redemption controls for institutional tokenised settlement (Scenario 2).

API Platform Access

Secure OAuth2/mTLS API gateway with ISO 20022 and REST payload support.

Custom Corridor Deployment

Configurable corridor rollout, localisation, and participant enablement.

FX Aggregation & Matching

Rate agreement APIs, quote locking, and match/queue orchestration.

Compliance & RegTech Services

Embedded AML/CFT screening, risk signals, and audit exports.

Data & Insights

Corridor analytics dashboards, MI, and regulator-ready reporting packages.

Client Onboarding & Integration

KYB/KYC, whitelisting, technical certification, and go-live support.

Technology architecture

MPSS is built as a modular, event-driven microservices platform designed for high availability, low latency, and regulator-grade observability. The orchestration engine coordinates transaction state transitions deterministically, while integrations are secured through modern API controls.

- + Stateless orchestration and sequencing for atomic execution

- + ISO 20022 messaging support with JSON-compatible extensions

- + Real-time monitoring dashboards and exception logs

- + Cryptographic audit anchors for non-repudiation and compliance traceability

- + Resilience-first deployment with regional redundancy and DR capability

Who can participate

MPSS is available exclusively to regulated institutions. We do not onboard retail clients and we do not offer retail payment accounts. Participation is subject to licensing verification, KYB, sanctions/PEP screening, and technical certification.

- + Banks (licensed by relevant regulators)

- + Payment institutions, PSPs, and EMIs (licensed/authorised)

- + Investment firms and regulated treasury desks

- + Approved financial infrastructure operators and liquidity providers

Get connected in 4 steps

1) Eligibility & pre-screening

License validation, jurisdiction checks, initial risk scoring, and sanctions screening.

2) KYB / governance pack

Corporate documentation, UBO mapping, authorised signatories, and policy alignment.

3) Technical integration

API keys, mTLS setup, webhook configuration, ISO 20022 payload testing, and certification.

4) Corridor activation

Pilot flows, operational readiness checks, and controlled go-live with monitoring.

Operational principle

MPSS is designed to remain infrastructure-only and non-custodial. Client funds remain safeguarded with licensed banks, with full reconciliation and reporting designed for institutional assurance.

Commercial model

MPSS is delivered as a usage-based SaaS/PaaS platform for institutions, typically combining onboarding/integration fees, platform access, per-transaction settlement fees, and (where applicable) issuance/redemption event fees for closed-loop tokenised settlement. FX economics are managed through agreed pricing terms between counterparties, supported by the MPSS quote and lock workflow.

Frequently asked questions

DISCOVER HOW TO CONNECT TO MPSS AS A PARTICIPANT

New Economy - New Finance...

Connect your institution to the UK–GCC corridor with an infrastructure-first settlement layer designed for atomic PvP, straight-through integration, and regulator-grade reporting.